Financial statements release January 1―December 31, 2022

Unofficial translation of the company release on March 3, 2023 at 10:50. In case the document differs from the original, the Finnish version prevails.

Partnera Corporation

Financial statements release January 1―December 31, 2022

A VERY CHALLENGING YEAR FOR KPA UNICON, WHILE FOAMIT GROUP’S NET SALES INCREASED

The figures for July–December 2021 and 2022 are unaudited, while the figures for January–December 2021 and 2022 are audited. The figures in parentheses refer to the corresponding period in the previous year, unless otherwise stated. The figures presented for the Due2Energy Oy group (hereafter referred to as “KPA Unicon”) for the full financial year 2021 are for the period May 1, 2021–December 31, 2021. The figures presented for Foamit Group Oy (hereafter referred to as “Foamit Group”) include Glasopor AS from September 1, 2021 onwards.

JULY–DECEMBER 2022

Partnera Group’s net sales amounted to EUR 46.2 (55.2) million, representing a year-on-year decrease of 16.4%. Foamit Group accounted for EUR 24.9 (18.5) million of the consolidated net sales, while KPA Unicon accounted for EUR 21.3 (36.7) million.

- EBITDA was EUR 0.4 (8.1) million.

- EBIT was EUR -11.5 (4.4) million.

- Profit before appropriations and taxes was EUR -17.6 (2.7) million.

- Earnings per share amounted to EUR -0.45 (0.05).

- The annualized return on equity was -61.9% (4.7%).

- In August, the company reinstated its outlook for 2022 as a result of improved predictability.

- In November, the Board of Directors of Foamit Group decided, on the basis of a preliminary assessment, to complete an investment plan with an estimated value of EUR 8–10 million.

- Partnera Group recognized write-downs and provisions totaling EUR 13.9 million in relation to KPA Unicon’s business.

- The financing of KPA Unicon involves substantial uncertainty with regard to the next 12 months, and this may affect the continuity of KPA Unicon’s operations.

JANUARY–DECEMBER 2022

Partnera Group’s net sales amounted to EUR 85.4 (78.2) million, representing year-on-year growth of 9.2%. Foamit Group accounted for EUR 45.7 (30.6) million of the consolidated net sales, while KPA Unicon accounted for EUR 39.7 (47.6) million.

- EBITDA was EUR -2.9 (11.5) million.

- EBIT was EUR -18.9 (5.6) million. The comparable operational EBIT was EUR -10.9 (5.2) million.

- Profit before appropriations and taxes was EUR -26.9 (4.4) million.

- Partnera Group recognized write-downs and provisions totaling EUR 18.0 million in relation to KPA Unicon’s business.

- Earnings per share amounted to EUR -0.67 (0.09).

- Return on equity was -41.4% (4.6%).

- On May 4, 2022, Partnera paid dividends of EUR 0.08 per share in accordance with the resolution of the General Meeting of Shareholders.

- The Board of Directors proposes to the Annual General Meeting that no dividend be paid for the financial year 2022.

KEY FIGURES

| EUR million | H2/20221) | H2/20211) | 2022 | 2021 | |

|---|---|---|---|---|---|

| Net sales | 46.2 | 55.2 | 85.4 | 78.2 | |

| EBITDA | 0.4 | 8.1 | -2.9 | 11.5 | |

| % of net sales | 0.9 | 14.6 | -3.4 | 14.7 | |

| EBIT | -11.5 | 4.4 | -18.9 | 5.6 | |

| % of net sales | -24.9 | 8.0 | -22.1 | 7.1 | |

| Comparable operational EBIT2) | -3.5 | 4.0 | -10.9 | 5.2 | |

| Profit before appropriations and taxes | -17.6 | 2.7 | -26.9 | 4.4 | |

| % of net sales | -38.1 | 4.9 | -31.5 | 5.6 | |

| Profit for the financial year | -16.4 | 1.7 | -24.1 | 3.3 | |

| % of net sales | -35.6 | 3.0 | -28.3 | 4.2 | |

| Earnings per share, EUR | -0.45 | 0.05 | -0.67 | 0.09 | |

| Balance sheet total | 152.7 | 182.5 | 152.7 | 182.5 | |

| Investments | 1.7 | 4.7 | 3.2 | 5.7 | |

| Number of personnel at the end of the period | 299 | 309 | 299 | 309 | |

| Equity | 44.9 | 71.7 | 44.9 | 71.7 | |

| Return on equity, annualized, % | -61.9 | 4.7 | -41.4 | 4.6 | |

| Equity per share, EUR | 1.24 | 1.98 | 1.24 | 1.98 | |

| Equity ratio, % | 31.5 | 41.6 | 31.5 | 41.6 | |

| Dividend per share, EUR | 0.003) | 0.08 |

1) Unaudited

2) Excluding the reported non-recurring items related to the sale of the Arkistokatu 4 property and the write-down of goodwill.

3) The Board of Directors’ dividend proposal to the General Meeting

OUTLOOK FOR 2023

Partnera is not specifying its outlook for 2023 for the time being due to the uncertainties associated with the KPA Unicon business.

PARTNERA CEO JARI PIRKOLA

On the whole, 2022 was a very challenging year for Partnera. Due to difficulties with KPA Unicon’s project deliveries, Partnera recognized a significant write-down of goodwill and provisions for the negative effects of projects. Uncertainty and risks have been increased by the prolonged COVID-19 pandemic and the war in Ukraine. Foamit Group’s net sales increased in spite of the challenging market conditions.

For Foamit Group, demand remained good during the year, and net sales grew by 49% in January–December 2022. While the acquisition of the Norway-based Glasopor was a factor behind the increase in net sales, Foamit Group’s business also grew organically by 23%, driven particularly by the successful expansion of the customer base.

Foamit Group’s profitability improved after a weak start to the year, when war-related increases in energy prices significantly drove up the costs of raw materials and transport. Towards the end of the year, cost increases were partly passed on to prices, and the company implemented various efficiency measures to improve profitability. These measures are still ongoing.

One of the highlights of the year was a large order for foam glass in Norway. The deliveries will be made during 2022–2023. Foam glass was chosen as a lightening material for a hospital construction project in Drammen, Norway, due to its technical and environmental attributes.

Near the end of the year, we also made the important decision to complete the planning on a significant investment by Foamit Group. When completed, the investment will double the production capacity of the Onsoy factory in Norway. In connection with the upgrade, the production equipment will be converted to be powered by electricity instead of fossil fuels. As the factory uses renewable electricity, its production will be almost zero-emission in the future.

The development of KPA Unicon’s business was compromised by prolonged delivery difficulties. The slower-than-expected completion of projects that have delivery difficulties, the cancellation of a project in Denmark and the general rise in costs led to profitability being considerably below the target. Furthermore, the war in Ukraine has increased the probability of credit loss risk related to KPA Unicon’s Russian subsidiary. For these reasons, we recognized write-downs and provisions totaling EUR 18.0 million during the financial year in relation to KPA Unicon’s business. The capital of KPA Unicon’s group companies was strengthened by converting loans and credit facilities into shares and subordinated loans in proportion to the shareholdings.

KPA Unicon’s net sales declined by 16.7% in January–December 2022. In spite of the challenges, KPA Unicon’s service business developed according to plan during the year, and the company received several new orders for plant modernization. Profitability was weakened and business was contracted by the slower-than-expected progress of projects that have gone on for a long time, as well as delays in new projects. The comparable operational EBIT was also affected by project-specific write-downs and provisions totaling EUR 10.0 million, as well as the rise in the general cost level. In KPA Unicon’s project business, forecasts concerning the progress of projects and the cash flow received from them involves uncertainty. KPA Unicon’s liquidity situation remains weak. The financing of KPA Unicon involves substantial uncertainty with regard to the next 12 months, and this may affect the continuity of KPA Unicon’s operations. Securing financing is subject to KPA Unicon’s project completion and sales progressing according to plan and the successful negotiation of KPA Unicon’s financing solution with financing providers. KPA Unicon’s situation does not affect the continuity of operations of the parent company Partnera.

During the year, KPA Unicon updated its strategy and made changes to its organization. Matti Huttunen was appointed as the company’s new Managing Director after the end of the review period, in January 2023. Under his leadership, KPA Unicon’s focus going forward will be on strong technology expertise and the service business. With regard to the scope of plant deliveries, the focus will be on partial deliveries. Complete delivery projects will only be offered with careful consideration. Partnera is assessing its strategic options concerning its ownership of KPA Unicon.

The operating environment in 2023 is expected to remain challenging in spite of the rise in the costs levelling off. We expect Foamit’s market position to remain good, although the potential slowing of economic growth does cast a shadow over the construction industry. KPA Unicon’s markets are active due to the energy crisis and the green transition, and the company will seek to target its sales activities in accordance with its new strategy. KPA Unicon’s primary goals are to improve its liquidity, complete the delayed delivery projects and build a foundation for profitable growth.

BUSINESS PERFORMANCE AND THE OPERATING ENVIRONMENT

Foamit Group

Foamit Group Oy is a glass recycling company and foam glass producer whose subsidiaries – Uusioaines Oy, Hasopor AB and Glasopor AS – together constitute one of Europe’s leading foam glass manufacturers. Foamit Group takes in and processes glass to be recycled, and manufactures foam glass from the sidestreams of glass recycling. Foam glass is a 100% recycled lightening and insulating material. Partnera owns approximately 63% of Foamit Group, while Finnish Industry Investment Ltd owns approximately 32%.

In January–December 2022, Foamit Group’s net sales increased by 49% and amounted to EUR 45.7 (30.6) million. One factor behind the growth was the acquisition of the Norway-based company Glasopor in September 2021. Net sales also grew organically by 23%, particularly due to the successful expansion of the customer base in the foam glass business. In the glass business, the lifting of the pandemic-related restrictions was reflected in a small increase in the volume of recycled glass received. Sales of purified recycled glass increased by about 35% year-on-year as high energy prices increased the demand for recycled glass.

The war in Ukraine led to higher costs and thereby had a negative impact on Foamit Group’s foam glass business, especially in the Finnish market, where the cyclical nature of infrastructure construction has led to projects being suspended and postponed. The building construction market grew in Finland and Norway. In Sweden, the foam glass business developed steadily compared to the previous year.

Foamit Group’s EBITDA amounted to EUR 6.5 (6.6) million in January–December 2022. Profitability was improved after a weak start to the year, when war-related increases in energy and electricity prices had both a direct and indirect impact by significantly raising the cost of raw materials and transport. Towards the end of the year, the rising costs could be partially passed on to prices. In its Norwegian and Swedish country companies, Foamit Group implemented – and will continue to implement – efficiency measures focusing on improving the profitability of sales, increasing production efficiency, saving energy and reducing fixed costs.

Foamit Group’s order book amounted to EUR 19.9 (18.6) million at the end of the financial year. In the first half of the year, Foamit Group received a major order to supply foam glass for a hospital construction project in Drammen, Norway, during 2022–2023. Foam glass was chosen as a lightening material for the hospital foundations because of its technical and environmental properties. A satisfactory amount of medium-sized and small orders were received in Sweden and Finland.

KPA Unicon Group

KPA Unicon Group designs and implements new clean energy solutions for domestic and international customers. The company also overhauls, maintains and operates existing energy production plants and offers energy production capacity as a service. KPA Unicon’s energy production solutions make it possible to decrease the use of fossil fuels by utilizing various kinds of biomasses, by-products and waste fractions. Partnera owns 70% of KPA Unicon through Due2Energy Oy, and Prounicon Service Oy owns 30%.

KPA Unicon’s net sales in January–December 2022 amounted to EUR 39.7 (47.6) million. There were difficulties in KPA Unicon’s business operations related to plant deliveries in Bosnia and Herzegovina, Spain, New Zealand, Sweden and Denmark. Travel restrictions and rising costs caused by the Covid-19 pandemic have hampered progress on projects, and difficulties have escalated during the finalization phase of deliveries. Due to delays caused by delivery problems, KPA Unicon’s need for working capital increased and its liquidity deteriorated, remaining weak. The financing of KPA Unicon involves substantial uncertainty with regard to the next 12 months, and this may affect the continuity of KPA Unicon’s operations.

The continuation of the war in Ukraine increased the probability of credit loss risk related to KPA Unicon’s Russian subsidiary. Due to the war, KPA Unicon is refraining from new business activities in Russia, but its local subsidiary in Russia, OOO KPA Unicon, will continue to fulfill its contractual obligations for energy production with local staff.

Due to the difficulties with plant deliveries and the issues related to the Russian subsidiary, KPA Unicon recognized a total of EUR 10.0 million in write-downs and provisions in its comparable operational EBIT. In addition, Partnera decided to recognize a non-recurring write-down of approximately EUR 8 million on KPA Unicon’s goodwill due to the weakened future profit expectations, corresponding to about two-thirds of KPA Unicon’s goodwill on Partnera Group’s balance sheet. The write-down is not included in the comparable operational EBIT. The total amount of the write-downs and provisions is approximately EUR 18.0 million. In addition, the capital of KPA Unicon’s group companies was strengthened by converting loans and credit facilities into shares and subordinated loans in proportion to the shareholdings.

KPA Unicon’s EBITDA was EUR -8.5 (4.6) million in January–December 2022. In addition to the write-downs and reduction in business, profitability was weighed down by the general increase of costs and, in particular, the rise in steel prices. However, operational profitability excluding non-recurring items improved in the second half of 2022.

KPA Unicon’s service business developed according to plan during the financial year, and the company received new orders for plant modernization in Sweden, Belgium and Finland. KPA Unicon’s order book amounted to EUR 40.3 (42.4) million at the end of the financial year.

KPA Unicon continued the development of the PlantSys® product family by collaborating with various stakeholders to explore the use of artificial intelligence in controlling energy production. Development efforts also continued with regard to increasingly challenging recycled fuels, and cooperation agreements were signed in relation to the use of energy storage solutions.

KPA Unicon has sharpened its strategy. Going forward, the company will focus on technology deliveries and the service business. With regard to the scope of plant deliveries, the focus will be on partial deliveries. Complete deliveries will only be offered with careful consideration. Matti Huttunen was appointed as Unicon Group Oy’s new Managing Director after the end of the financial year. Huttunen took up his post on 16 January 2023. KPA Unicon’s previous Managing Director, Jukka-Pekka Kovanen, continues to be employed by the company in operational duties and as a member of the management team. Partnera is assessing its strategic options concerning its ownership of KPA Unicon.

FINANCIAL PERFORMANCE

Net sales

Partnera Group’s net sales in July–December 2022 totaled EUR 46.2 (55.2) million. Foamit Group’s net sales amounted to EUR 24.9 (18.5) million, and KPA Unicon’s net sales were EUR 21.3 (36.7) million.

In January–December 2022, Partnera Group’s net sales amounted to EUR 85.4 (78.2) million. Foamit Group’s net sales amounted to EUR 45.7 (30.6) million, and KPA Unicon’s net sales were EUR 39.7 (47.6) million.

| Net sales, EUR million | H2/2022 | H2/2021 | 2022 | 2021 |

|---|---|---|---|---|

| Foamit Group | 24.9 | 18.5 | 45.7 | 30.6 |

| KPA Unicon | 21.3 | 36.7 | 39.7 | 47.6 |

| Group total | 46.2 | 55.2 | 85.4 | 78.2 |

Profitability

Partnera Group’s EBITDA in July–December 2022 amounted to EUR 0.4 (8.1) million. The EBITDA includes a share of EUR -0.0 (-0.1) million of the result of associated companies. Foamit Group’s EBITDA was EUR 3.7 (4.3) million, and KPA Unicon’s EBITDA was EUR -2.6 (3.7) million.

In January–December 2022, Partnera Group’s EBITDA amounted to EUR -2.9 (11.5) million. The EBITDA includes a share of EUR 0.5 (0.5) million of the result of associated companies. Foamit Group’s EBITDA was EUR 6.5 (6.6) million, and KPA Unicon’s EBITDA was EUR -8.5 (4.6) million.

During the comparison period, Partnera Group’s EBITDA was improved by the reversal of a mandatory provision related to the Arkistokatu 4 property, which amounted to EUR 0.4 million.

| EBITDA, EUR million | H2/2022 | H1/2022 | 2022 | 2021 |

|---|---|---|---|---|

| Foamit Group | 3.7 | 4.3 | 6.5 | 6.6 |

| KPA Unicon | -2.6 | 3.7 | -8.5 | 4.6 |

| Share of the profit of associated companies | -0.0 | -0.1 | 0.5 | 0.5 |

| Group, other | -0.6 | 0.1 | -1.5 | -0.2 |

| Group, total | 0.4 | 8.1 | -2.9 | 11.5 |

Partnera Group’s EBIT in July–December 2022 amounted to EUR -11.5 (4.4) million. Foamit Group’s operational EBIT was EUR 1.2 (2.0) million, and KPA Unicon’s was EUR -12.0 (2.3) million.

Partnera Group’s EBIT in January–December amounted to EUR -18.9 (5.6) million. Foamit Group’s operational EBIT was EUR 1.4 (2.5) million, and KPA Unicon’s was EUR -19.3 (2.7) million.

Partnera Group’s comparable operational EBIT in January–December amounted to EUR -10.9 (5.2) million. The comparable EBIT includes write-downs and provisions recognized by KPA Unicon in the total amount of EUR 10.0 million. The write-down of goodwill, amounting to EUR 8.0 million, is not included in the comparable operational EBIT.

| EBIT, EUR million | H2/2022 | H2/2021 | 2022 | 2021 |

|---|---|---|---|---|

| Foamit Group | 1.2 | 2.0 | 1.4 | 2.5 |

| KPA Unicon | -12.0 | 2.3 | -19.3 | 2.7 |

| Group, other | -0.7 | 0.1 | -1.0 | 0.3 |

| Group, total | -11.5 | 4.4 | -18.9 | 5.6 |

| Items affecting comparability | 8.0 | -0.4 | 8.0 | -0.4 |

| Operational EBIT, comparable | -3.5 | 4.0 | -10.9 | 5.2 |

Partnera Group’s profit for July–December 2022 came to EUR -16.4 (1.7) million. Foamit Group’s profit was EUR -0.1 (1.1) million, and KPA Unicon’s was EUR -18.5 (0.6) million.

Partnera Group’s profit for January–December 2022 came to EUR -24.1 (3.3) million. The profit includes EUR 1.0 (1.0) million in dividend income from minority interests, and exchange rate effects recognized in financial income and expenses in the amount of EUR -0.7 (-0.0) million. The share of the profit of associated companies and dividend income from minority interests were on a par with the corresponding period in the previous year. The consolidated earnings per share amounted to EUR -0.67 (0.09).

| Profit, EUR million | H2/2022 | H2/2021 | 2022 | 2021 |

|---|---|---|---|---|

| Foamit Group | -0.1 | 1.1 | -1.6 | 0.7 |

| KPA Unicon | -18.5 | 0.6 | -28.4 | 0.6 |

| Group, other | 2.2 | 0.0 | 5.8 | 2.0 |

| Group, total | -16.4 | 1.7 | -24.1 | 3.3 |

Order book

The Group’s order book totaled EUR 60.2 (61.0) million at the end of the period under review. Foamit Group’s order book amounted to EUR 19.9 (18.6) million, and KPA Unicon’s order book was EUR 40.3 (42.4) million.

| Order book, EUR million | 2022 | 2021 |

|---|---|---|

| Foamit Group | 19.9 | 18.6 |

| KPA Unicon | 40.3 | 42.4 |

| Group, total | 60.2 | 61.0 |

Balance sheet, financing and investments

The consolidated balance sheet total amounted to EUR 152.7 (182.5) million on December 31, 2022. The Group’s equity totaled EUR 44.9 (71.7) million, or EUR 1.2 (2.0) per share. The Group’s equity ratio was 31.5% (41.6%). In determining the Group’s equity per share, properties, subsidiaries and associated companies are measured at acquisition cost. The Group’s primary financial performance indicator is return on equity, which was -41.4% (4.6%) for the period under review.

Partnera recognized a non-recurring write-down of approximately EUR 8 million on KPA Unicon’s goodwill due to the weakened future profit expectations, corresponding to about two-thirds of KPA Unicon’s goodwill on Partnera Group’s balance sheet. In addition, the capital of KPA Unicon’s group companies was strengthened by converting loans and credit facilities into shares and subordinated loans in proportion to the shareholdings.

At the end of the financial year, the Group had a total of EUR 10.5 (16.8) million in liquid funds in the form of low-risk securities and other investment instruments, as well as cash and cash equivalents.

Partnera Group’s financing arrangements include, for example, termination conditions related to financial performance indicators, namely the equity ratio, EBITDA, and the ratio between interest-bearing liabilities and EBITDA.

For Foamit Group, the terms of the financing arrangements were met at the end of the review period.

For KPA Unicon, the terms were not met at the end of the period. Negotiations are under way with the main financing providers regarding the potential consequences of failing to meet the covenant terms.

The financing of KPA Unicon involves substantial uncertainty with regard to the next 12 months, and this may affect the continuity of KPA Unicon’s operations. In the project business, forecasts concerning the progress of projects and the cash flow received from them involves uncertainty. Securing financing is subject to KPA Unicon’s project completion and sales progressing according to plan and the successful negotiation of KPA Unicon’s financing solution with financing providers. KPA Unicon’s situation does not affect the continuity of operations of the parent company Partnera.

In February 2023, a customer of KPA Unicon took out a bank guarantee in relation to a project in New Zealand, which creates a payment obligation to financing providers for KPA Unicon. KPA Unicon is in negotiations with the customer regarding the project-related demands and payments. Negotiations are also under way with the financing providers regarding the payment arrangements associated with the bank guarantee. Securing the continuity of KPA Unicon’s operations is contingent on an agreement being reached regarding the payment arrangements associated with the bank guarantee. KPA Unicon has disputed project receivables that may involve uncertainty and which may result in the estimated cash flow not being received. It is also uncertain whether the new sales previously forecast for 2023 being delayed to 2024 can be compensated for by other sales. The company has not budgeted sales income from suspended projects. If progress in the projects is achieved, it will have a positive effect on actual sales.

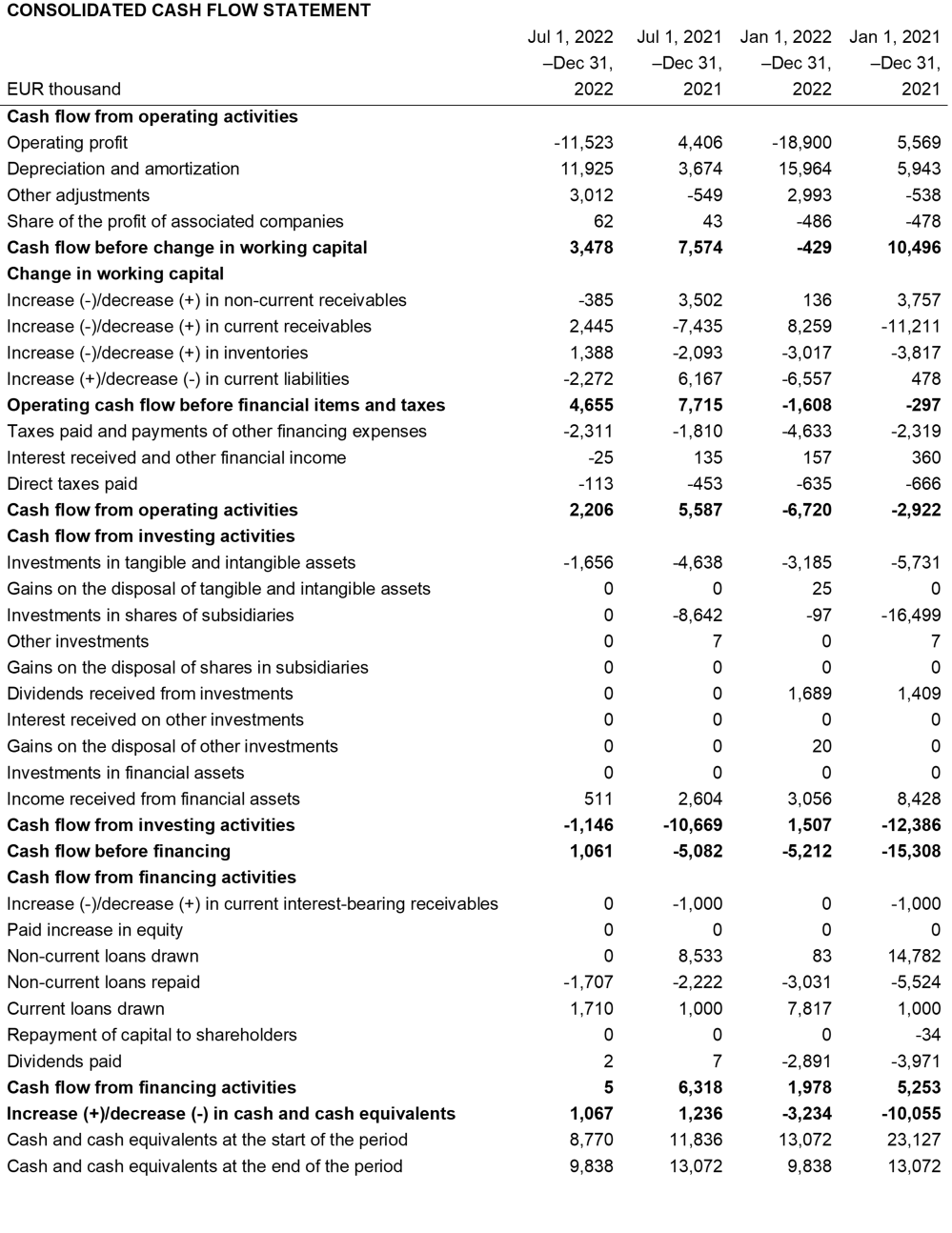

The Group’s cash and cash equivalents totaled EUR 9.8 (13.1) million on December 31, 2022. Net cash flow for the financial year came to EUR -3.2 (-10.1) million. The Group’s investments amounted to EUR 3.2 (5.7) million for the financial year.

In November 2022, the Board of Directors of Foamit Group decided, on the basis of a preliminary assessment, to complete an investment plan with an estimated value of EUR 8–10 million to modernize the production lines at the foam glass factory in Norway and increase the production capacity. The planned investment will increase Foamit Group’s foam glass production capacity by approximately 20%. The investment is expected to have a positive effect on Partnera’s net sales and profitability. The estimated time of completion of the planned investment would be the first quarter of 2024. The final investment decision will be made during the first half of 2023, when the investment plan has been finalized.

STRATEGIC HOLDINGS

In addition to Foamit Group and KPA Unicon, Partnera’s strategic holdings include Nordic Option Oy, in which Partnera holds a stake of approximately 34% through Oulu ICT Sijoitus Oy. Nordic Option is a venture capital fund in the form of a limited liability company. It provides growth financing to drive the growth of small and medium-sized enterprises in northern Finland. Oulu ICT Sijoitus is a wholly-owned subsidiary of Partnera that engages in investment activities.

OTHER HOLDINGS

The most significant of Partnera’s other holdings are Finda Oy and Telebusiness InWest Oy. Finda Oy is a Finnish investment group that engages in active portfolio investing, based on the principles of value investing. Finda Oy typically invests in listed companies. Partnera directly owns approximately 3.7% of Finda’s shares. In addition, Partnera owns approximately 36% of the shares of Telebusiness InWest Oy, which, in turn, owns approximately 5% of the shares of Finda.

PERSONNEL

At the end of 2022, the Group had 299 (309) employees, of whom 4 (4) worked for the parent company. The Group had 308 (219) employees on average during the period under review. The parent company’s average number of employees during the review period was 4 (4).

| Number of personnel at the end of the period | 2022 | 2021 |

|---|---|---|

| Foamit Group | 97 | 100 |

| KPA Unicon | 198 | 205 |

| Partnera | 4 | 4 |

| Group, total | 299 | 309 |

SUSTAINABLE DEVELOPMENT

Partnera aims to achieve profitable growth in sectors that accelerate the transition to the sustainable use of natural resources and a carbon-neutral society. Sustainability plays an important role in Partnera’s strategic decision-making: the objective is to engage in profitable business and build a more sustainable future by making a measurable, positive impact on the environment and society.

Foamit Group, which is one of Partnera’s current strategic holdings, is a glass recycling and foam glass manufacturing company with a vision of being a strong provider of foam glass and recycled glass solutions, and a company whose operations reduce the carbon footprint and have a sustainable impact on society. Foamit Group takes in and processes glass to be recycled, and manufactures foam glass from the sidestreams of glass recycling. Foam glass is a 100% recycled lightening and insulating material. Foam glass is suitable for infrastructure and building construction, and its environmental impacts during its lifecycle have been authenticated with a verified EPD.

Partnera’s other strategic holding is in KPA Unicon, a company that designs and implements new clean energy solutions for domestic and international customers. The company’s solutions make it possible to decrease the use of fossil fuels by utilizing various kinds of biomasses, by-products and waste fractions. KPA Unicon’s growth is supported by the change of the global energy system towards decentralized low-emission energy production and the need to promote the circular economy.

Partnera will publish its second sustainability report in March 2023. The report will contain information on the business group’s approach to sustainability, and the most vital actions of its subsidiaries, Foamit Group and KPA Unicon, to support sustainable development.

STRATEGY AND FINANCIAL TARGETS

Partnera aims to engage in profitable business by building a more sustainable future through having a measurable, positive impact on the environment and society. The company focuses on themes that are affected by the excellent growth opportunities brought about by global megatrends. These themes include the responsible use of natural resources and a carbon-neutral society. The company uses its expertise and networks to develop business and the industry in accordance with these themes.

The cornerstones of Partnera’s strategy:

- We channel our investments into strategic ownerships according to the principles of impact investment.

- We are a majority owner and develop our companies’ business in an active and responsible manner.

- We seek to seize the opportunities arising from sustainable development to grow our business both organically and inorganically on an international scale.

Partnera has set the following medium to long-term financial targets:

- return on equity over 10%;

- a stable dividend for shareholders; and

- the majority of assets to be invested are placed in strategic holdings.

These targets are not predictions for the future development of the company.

GENERAL MEETING AND GOVERNANCE

Partnera Corporation’s Annual General Meeting was held on April 21, 2022, at the company’s head office in Oulu, Finland. Shareholders and their proxy representatives had the opportunity to participate in the General Meeting and exercise their rights only by voting in advance or by presenting counterproposals or questions in advance. Attending the meeting in person was not possible. The General Meeting was organized in accordance with the temporary legislation (375/2021) approved by the Finnish Parliament concerning exceptional meeting procedures.

The General Meeting adopted the financial statements and discharged the members of the Board of Directors and the CEO from liability for the financial year 2021.

In accordance with the proposal of the Board of Directors, the General Meeting resolved that a dividend of EUR 0.08 per share be paid for the financial year that ended on December 31, 2021, and that the remaining distributable funds be retained in the company’s unrestricted equity.

In accordance with the proposal of the Shareholders’ Nomination Committee, the General Meeting confirmed the number of members of the Board of Directors as six (6). Martin Grotenfelt, Mirja Illikainen, Marko Järvinen, Pekka Kunnari and Sami Mäentausta were re-elected as members of the Board of Directors. Erja Sankari was elected to the Board of Directors as a new member. Pekka Kunnari was elected as the Chair of the Board of Directors, with Martin Grotenfelt as the Deputy Chair.

The General Meeting resolved that the Chair of the Board of Directors be paid an annual fee of EUR 18,000 and the Deputy Chair and the other members of the Board of Directors an annual fee of EUR 10,000 each. In addition to the annual fees, the General Meeting resolved that the members of the Board of Directors and its committees be paid a meeting fee of EUR 400 per meeting, and the Chair of the Board of Directors and the chairpersons of the committees EUR 800 per meeting. The travel expenses of the members of the Board of Directors and its committees are compensated in accordance with the company’s travel policy.

The audit firm Ernst & Young was re-elected as the company’s auditor, with authorized public accountant Jari Karppinen continuing as the responsible auditor. The auditor’s fees will be paid in accordance with their reasonable invoice approved by the company.

THE BOARD OF DIRECTORS’ CURRENT AUTHORIZATIONS

The General Meeting of April 21, 2022, authorized the Board of Directors to decide on issuing at most a total of 7,480,000 shares or issuing special rights entitling to shares, in accordance with Chapter 10, Section 1 of the Limited Liability Companies Act, in one or more instalments while the authorization remains in effect. The Board of Directors can decide to either issue new shares or shares held by the company. The proposed maximum amount of the authorization corresponds to approximately 20% of the company’s total shares.

The authorization can be used to develop the company’s capital structure, expand its ownership, fund or implement acquisitions or other arrangements, implement a share-based remuneration scheme, or for other purposes decided upon by the Board of Directors.

The authorization includes the Board of Directors’ right to decide on all conditions of share issuance and provision of special rights in accordance with Chapter 10, Section 1 of the Limited Liability Companies Act, including shares or recipients of special rights entitling to shares, and the consideration to be paid. The authorization thereby also includes the right to issue shares or special rights in deviation from the pre-emptive subscription right of shareholders, according to the prerequisites stipulated by the law.

The authorization is valid until the next Annual General Meeting, but no later than June 30, 2023, and it replaces the corresponding authorization granted to the Board of Directors by the Annual General Meeting of April 21, 2021.

SHARES AND SHAREHOLDERS

Partnera Corporation’s share capital and the number of shares remained unchanged during the financial year. Partnera Corporation’s share capital on December 31, 2022, amounted to EUR 6,413,182.05, and the number of shares was 37,401,966. The company has one series of shares and all shares confer one vote and equal rights to dividends. At the end of the financial year, the parent company held a total of 1,240,772 treasury shares.

On December 31, 2022, Partnera Corporation had a total of 25,983 (26,594) shareholders. The 10 largest registered shareholders collectively held 65.8% (65.6%) of the company’s shares.

| Shareholder | Number of shares | Shares, % |

| City of Oulu | 17,634,491 | 47.15 |

| Arvo Invest Nordic Oy | 3,810,652 | 10.19 |

| Partnera Corporation | 1,240,772 | 3.32 |

| Pakarinen Janne Heikki Petteri | 433,500 | 1.16 |

| Japak Oy | 402,340 | 1.08 |

| Oulun Kulta Oy | 267,000 | 0.71 |

| Mininvest Oy | 239,603 | 0.64 |

| Pohjanmaan Arvo Sijoitusosuuskunta | 212,500 | 0.57 |

| Haloan Oy | 189,949 | 0.51 |

| Osuuskauppa Arina | 177,850 | 0.48 |

| 10 largest shareholders, total | 24,608,657 | 65.80 |

| Others | 12,793,309 | 34.20 |

| Total | 37,401,966 | 100 |

TRADING IN THE COMPANY’S SHARES

During the period January 1–December 31, 2022, a total of 1,694,256 Partnera shares, or 4.5% of the total number of shares, were traded on Nasdaq First North Growth Market Finland. The total value of the trading was EUR 2.58 million.

On the final trading day of the financial year, the closing price was EUR 0.75 per share. The share price low during the financial year was EUR 0.71, the high was EUR 2.74, and the average share price was EUR 1.52 per share. At the end of the financial year, Partnera Group’s market capitalization was EUR 28.1 million. At the end of 2021, the market capitalization was EUR 83.4 million.

SHARE-BASED INCENTIVE SCHEMES

In March 2022, Partnera Corporation’s Board of Directors decided on the new earnings period for the long-term incentive scheme for the Group’s key personnel. The purpose of the scheme is to bring together the objectives of the company’s owners and the scheme’s participants in order to increase the value of the company in the long term, as well as commit key personnel to the company and offer them a competitive remuneration system based on earning and accumulating the company’s shares.

The scheme has three earnings periods, the calendar years 2021–2023, 2022–2024, and 2023–2025. The Board of Directors will decide the scheme’s earnings criteria and the aims set for each criterion at the start of each earnings period.

The remuneration will be paid partly in the company’s shares and partly in cash in 2024, 2025, and 2026. The cash portion is intended to cover the taxes and other levies incurred by the participant due to the remuneration. As a rule, remuneration will not be paid if the participant’s employment or service with the company ends before the payment of the remuneration.

The remuneration from the scheme’s second earnings period will be based on the total shareholder return (TSR) of Partnera Corporation’s shares during the period 2022–2024.

The remuneration to be paid based on the earnings period of 2022–2024, with the number of participants at the start of the period, corresponds to, at most, the value of 74,968 of Partnera Corporation’s shares, including the portion to be paid as cash. The target group of the scheme is the persons belonging to the company’s management during the earnings period of 2022–2024.

The Board of Directors decides on the offering of shares in relation to the scheme within the bounds of the authorizations granted in the General Meeting. The Board of Directors can also decide on paying remuneration as cash.

THE BOARD’S PROPOSAL ON THE DISTRIBUTION OF PROFIT

According to the parent company’s balance sheet on December 31, 2022, the parent company’s distributable funds amount to EUR 47,458,509.81, of which the loss for the financial year is EUR -7,384,218.38. The Board proposes to the Annual General Meeting that no dividend be paid on the basis of the balance sheet adopted for the financial year January 1–December 31, 2022.

Partnera Corporation’s aim is to distribute a stable dividend. The dividend baseline is 50% of the annual financial result, noting also the company’s strategic goals and financial state.

RISK MANAGEMENT AND THE MOST SIGNIFICANT NEAR-TERM RISKS

Partnera’s risk management is aimed at the comprehensive and proactive management of risks in accordance with the company’s risk management policy. Partnera aims to detect and identify factors that could have a negative impact on the achievement of the company’s targets in the long or short term, and to undertake the necessary measures to manage such factors. In risk management, an important role is played by risk management at the group company level, the central aspects of which are organized by the Group’s subsidiaries and associated companies. Partnera promotes the risk management of the group companies by engaging in active ownership steering and by participating in the work of the group companies’ boards of directors.

Through its operations, Partnera is exposed to general market risks, as well as risks related to the group companies’ business operations, financial risks, and risks related to the execution of the Group’s growth strategy.

Market risks

Increasing uncertainty in the international economy and international politics may have an impact on the demand for, and costs of, the products and services of Partnera and its subsidiaries. Such factors may lead to the postponement or complete cancellation of investments. Rising costs and material availability issues have an impact on the competitiveness and profitability of the Group’s subsidiaries.

The customers of Partnera’s subsidiaries include public sector entities and organizations that are funded by public expenditure. Consequently, Partnera’s subsidiaries are exposed to cyclical fluctuations in public investment. Foamit Group’s customer base also includes customers that engage in the construction business, which means that Foamit Group is exposed to cyclical fluctuations in construction. KPA Unicon’s customers include industrial organizations for whom the timing of energy investments may be affected by general and industry-specific cyclical fluctuations. These risks may have a significant impact on Partnera’s net sales and EBIT.

Business risks

Through its operations, Partnera is exposed to the business risks of its subsidiaries, which are influenced by the increasing uncertainty in the economy and international politics. The group companies’ business risks are related to areas such as contracts, cost assessment, schedules, quality, performance, subcontractors and material management. These factors may lead to higher costs, payment delays and an increased risk of credit losses.

Partnera and its subsidiaries are also increasingly exposed to legal, economic, political and regulatory risks related to the countries in which the companies’ customers or partners are located. Such risks may lead to delays in deliveries, orders being lower than projected, exchange rate losses, changes in the customers’ ability to pay and payment behavior, higher costs, and legal proceedings and related expenses.

The operational activities of Partnera and its subsidiaries, and the development of the business areas, may involve structural changes in the business environment. If such changes materialize, they may trigger the realization of the aforementioned risks. Examples of such changes and events include technological development, digitalization, sustainability risks and risks related to cyber security. If such risks materialize, they may lead to services failing to meet the customers’ expectations, disruptions in services and processes, financial losses due to criminal actions, and/or reputational damage. In addition, changes in the regulatory environment may have a significant impact on business operations.

Partnera’s subsidiaries have significant customer projects, and if those projects were to continue in a manner that deviates from expectations, it could lead to significant deviations with regard to the future outlook. The typical risks associated with the project business include a dependence on actual order and delivery volumes, timing-related risks, and potential delays in projects. These factors may be reflected in weaker profitability or fluctuations in cash flow.

The COVID-19 pandemic has caused changes in the Group’s operating environment, and continues to have an impact on it. Among other things, the COVID-19 pandemic has affected raw material prices, investment decisions, the implementation and delivery schedules of projects, and the availability and mobility of labor. The duration of the situation and its impacts on business operations and financial performance are difficult to estimate, but it has led to a substantially increased need for working capital.

Expanding Partnera Group through new acquisitions is an important component of the execution of the Group’s strategy. Acquisitions involve risks, and these risks are managed by carrying out acquisitions in accordance with a five-stage process defined by the company, using external experts.

The impacts of the war in Ukraine

The war in Ukraine has had an impact on the business operations of Partnera and its subsidiaries by increasing market uncertainty and accelerating price inflation. KPA Unicon has a locally operating subsidiary in Russia, OOO KPA Unicon, which is continuing to fulfill its contractual obligations for energy production with local staff. Due to the war in Ukraine, KPA Unicon is refraining from new business activities in Russia. According to the current estimate, the potential financial risk associated with KPA Unicon’s operations in Russia are limited to the impairment of the value of the subsidiary and potential credit losses. KPA Unicon regularly monitors the development of the situation in Russia and its impacts on the activities of the Russian subsidiary.

Financial risks

Partnera is exposed to interest rate and exchange rate risk, credit loss risk, liquidity risk and price risk, as well as investment and financial market risks in connection with the investment of liquid assets, for example. Changes in the investment and financial markets have an impact on the value of Partnera’s parent company’s liquid assets. In accordance with the Group’s strategy, its liquid assets have been invested in low-risk financial instruments.

Partnera finances its business activities through revenue from operational business activities and by additional financing obtained on market terms. The company has loans and credit limit agreements that include normal terms and conditions concerning the equity ratio and EBITDA as well as the disposal and collateralization of assets. Violations of the terms of financing and failure to fulfill other obligations under financing agreements could significantly increase the costs of financing and even jeopardize the continued financing of Partnera or its subsidiaries. In addition, rising inflation may lead to higher interest rates, which increase financing costs and reduce the profitability of Partnera and its subsidiaries.

KPA Unicon’s business typically involves providing guarantees to customers and other stakeholders, particularly in large projects, as collateral for advance payments, the performance of contractual obligations and warranty period obligations, for example. Financial intermediaries typically provide these guarantees on KPA Unicon’s behalf. It is not certain that the company will have continuous access to such guarantees from financial intermediaries at competitive terms, or at all. Failure to access such guarantees could have an adverse impact on KPA Unicon’s business operations and financial position. Economic uncertainty, geopolitical uncertainty and KPA Unicon’s financial position have increased the general risk level with regard to the availability of guarantee limits.

KPA Unicon’s financial covenants were not met at the end of the review period. Negotiations are under way with the main financing providers regarding the potential consequences of failing to meet the covenant terms.

The financing of KPA Unicon involves substantial uncertainty with regard to the next 12 months, and this may affect the continuity of KPA Unicon’s operations. In the project business, forecasts concerning the progress of projects and the cash flow received from them involves uncertainty. Securing financing is subject to KPA Unicon’s project completion and sales progressing according to plan and the successful negotiation of KPA Unicon’s financing solution with financing providers. KPA Unicon’s situation does not affect the continuity of operations of the parent company Partnera.

The realization of business risks or the weaker-than-expected development of business could weaken the availability and terms of financing and lead to a need for additional financing and additional working capital.

EVENTS AFTER THE REVIEW PERIOD

On January 16, 2023, the Board of Directors of KPA Unicon appointed Matti Huttunen as the company’s new Managing Director. Huttunen was previously the Chair of the company’s Board of Directors. The previous Managing Director, Jukka-Pekka Kovanen, continues as a member of the management team and is in charge of strategic projects. In connection with the change, the company’s shareholders appointed Vesa Silaskivi as the new Chair of the Board of Directors.

In February 2023, a customer of KPA Unicon took out a bank guarantee in relation to a project in New Zealand, which creates a payment obligation to financing providers for the company. KPA Unicon is in negotiations with the customer regarding the project-related demands and payments. Negotiations are also under way with the financing providers regarding the payment arrangements associated with the bank guarantee. Securing the continuity of KPA Unicon’s operations is contingent on an agreement being reached regarding the payment arrangements associated with the bank guarantee.

FINANCIAL REPORTING AND GENERAL MEETING IN 2023

The financial statements and Board of Directors’ report for the financial year 2021 will be published on March 22, 2023.

The half-year financial review for January–June 2023 will be published on Thursday, August 24, 2023.

All of Partnera’s financial reports and releases are published in Finnish and, starting from the financial year 2022, also in English. The reports and releases are available after their publication on the company’s website.

Partnera Corporation’s Annual General Meeting is scheduled to be held at 11:00 on Thursday, April 20, 2023, in Oulu, Finland.

Information on the Annual General Meeting and instructions to shareholders are provided in the notice of the Annual General Meeting, which will be published on March 22, 2023, and on the company’s website at https://www.partnera.fi.

Oulu, March 3, 2023

Partnera Corporation

Board of Directors

More information:

Jari Pirkola, CEO, Partnera Corporation

telephone: +358 400 867 784

e-mail: jari.pirkola@partnera.fi

Certified advisor, EY Advisory Oy

telephone: +358 207 280 190

e-mail: ollipekka.kotkajuuri@fi.ey.com

Distribution:

Nasdaq Helsinki

Key media

Partnera in brief:

Partnera is an international business group that owns companies that promote sustainable development in the circular economy and energy sectors, for example. Through our operations, we create shareholder value and a more sustainable future. The companies we own produce products and services for society’s needs, and their business activities are aligned with the megatrends that are shaping the business environment. We act as a partner to the companies we own, and our aim is to develop their business and value with a long-term approach. In building our business group in accordance with our strategy, we are also an impact investor whose aim is to use its capital on the development of business activities that can promote positive impacts on society and progress towards the goals of sustainable development. Partnera’s shares are listed on Nasdaq First North Growth Market Finland. www.partnera.fi

Tables

Accounting policies

The figures for July–December 2022 and 2021 are unaudited and prepared in accordance with the Finnish Accounting Standards (FAS). The figures for January–December 2022 and 2021 are audited. The figures in the tables are rounded and presented in thousands of euros.

Calculation formulas for the key figures