Half-year report January 1 - June 30, 2023 (unaudited)

Unofficial translation of the company release on August 24, 2023 at 2.20 p.m. EEST. In case the document differs from the original, the Finnish version prevails.

Partnera Corporation

Company release, August 24, 2023, 2:20 p.m. EEST

HALF-YEAR REPORT JANUARY–JUNE 2023 (UNAUDITED)

PARTNERA GROUP’S EBIT TURNED CLEARLY POSITIVE

The figures for January–June 2023 and January–June 2022 are unaudited, while the figures for January–December 2022 are audited. The figures in parentheses refer to the corresponding period in the previous year, unless otherwise stated. The income statement figures of KPA Unicon, which was part of the Partnera Group (hereinafter Partnera), presented in the Half-year report are for the period 1 January 2023–30 April 2023, after which KPA Unicon is no longer consolidated into the Group accounting.

JANUARY–JUNE 2023 IN BRIEF

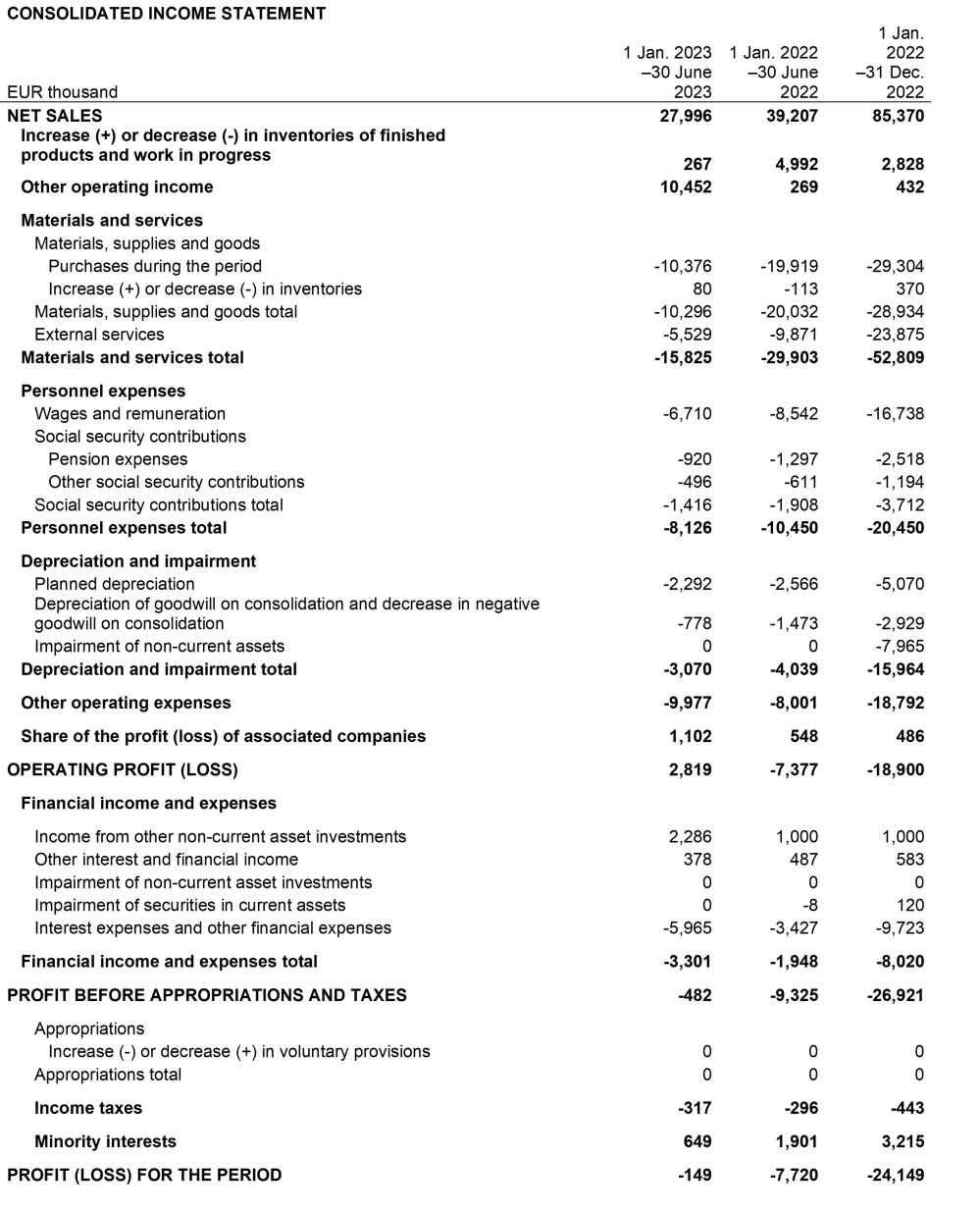

- Partnera’s net sales amounted to EUR 28.0 (39.2) million, representing a year-on-year decrease of 28.6%.

- EBITDA was EUR 5.9 (-3.3) million.

- EBIT was EUR 2.8 (-7.4) million.

- The comparable operational EBIT was EUR 7.1 (-7.4) million.

- Profit before appropriations and taxes was EUR -0.5 (-9.3) million.

- Earnings per share amounted to EUR -0.00 (-0.21).

- The annualised return on equity was -0.7% (-23.2%).

- On 20 April 2023, the Annual General Meeting decided, in accordance with the proposal of the Board of Directors, that no dividend be paid on the basis of the balance sheet adopted for the financial year 1 January–31 December 2022.

- On 25 May 2023, the Oulu District Court issued its decision on the bankruptcy of Due2Energy Oy, KPA Unicon Group Oy and KPA Unicon Oy.

- Peter Vapaamies started working as the Interim CEO on 17 May 2023.

- Partnera started work to reorient its strategy and operations.

- Peter Vapaamies was appointed as the Group’s CEO as of 24 August 2023.

OUTLOOK FOR 2023

Partnera announced on 29 June 2023 that it will update its strategy. Partnera's strategy is to own and develop industrial companies that support the building of a sustainable future, in particular the circular economy. Holdings can vary in size and ownership structure, including minority shareholdings. Partnera will review the status and situation of its holdings and their fit with the company's refined strategy.

Due to the strategy update, Partnera does not provide a short-term outlook.

KEY FIGURES

| EUR million | H1/20231) | H1/20221) | 2022 |

| Net sales | 28.0 | 39.2 | 85.4 |

| EBITDA | 5.9 | -3.3 | -2.9 |

| % of net sales | 21.0 | -8.5 | -3.4 |

| EBIT | 2.8 | -7.4 | -18.9 |

| % of net sales | 10.1 | -18.8 | -22.1 |

| Comparable operational EBIT2) | 7.1 | -7.4 | -10.9 |

| Profit before appropriations and taxes | -0.5 | -9.3 | -26.9 |

| % of net sales | -1.7 | -23.8 | -31.5 |

| Profit for the financial year | -0.1 | -7.7 | -24.1 |

| % of net sales | -0.5 | -19.7 | -28.3 |

| Earnings per share, EUR | -0.00 | -0.21 | -0.67 |

| Balance sheet total | 86.8 | 170.1 | 152.7 |

| Investments | 1.2 | 1.5 | 3.2 |

| Number of personnel at the end of the period | 103 | 325 | 299 |

| Equity | 45.0 | 61.4 | 44.9 |

| Return on equity, annualised, % | -0.7 | -23.2 | -41.4 |

| Equity per share, EUR | 1.24 | 1.70 | 1.24 |

| Equity ratio, % | 53.6 | 37.7 | 31.5 |

| Dividend per share, EUR | 0.00 |

1) Unaudited

2) The comparable operational EBIT has been adjusted for the write-down of goodwill.

PETER VAPAAMIES, CEO

Partnera Group’s EBIT improved significantly year on year, amounting to EUR 2.8 (-7.4) million. EBIT was influenced by the positive profit development of Partnera’s holdings and the exclusion of the loss-making KPA Unicon from the Group. During spring 2023, it became evident that there was no realistic chance to continue the operations of our energy solutions subsidiary KPA Unicon, so the company was declared bankrupt. The bankruptcy did not have a negative impact on the financial result for the review period, nor, according to the current estimate, on the financial result for 2023.

For Foamit Group, demand remained good during the first half of the year, and total net sales grew by 2.4% in January–June 2023. Foamit Group’s EBIT was EUR 1.4 (0.2) million, showing a significant year-on-year increase. Demand in the Norwegian and Swedish markets was good, especially due to infrastructure construction projects. In Finland, the slowdown in building construction impaired the development of the company’s order book. General cost increases could be partially passed on to prices, in addition to which Foamit Group implemented numerous efficiency measures to improve profitability. The company’s financial result was burdened by the weakening of the Norwegian and Swedish krona in relation to the euro, which was recorded as imputed exchange rate differences.

The operating environment in 2023 is expected to remain challenging in spite of the rise in the costs levelling off. We expect Foamit Group’s market position to remain good, although the slowdown in building construction continues to cast a shadow over the construction industry. The market outlook is more positively influenced by infrastructure construction, which is not as sensitive to economic cycles as building construction.

The total funds used on KPA Unicon amounted to approximately EUR 25 million. The amount does not include any funds that may be paid to Partnera from the warranty and indemnity insurance, the sellers or the bankruptcy estate. Following KPA Unicon’s bankruptcy, Partnera’s balance sheet decreased significantly in the review period, showing a year-on-year decrease of EUR 83.3 million. Profit and balance sheet impacts increased Partnera’s equity ratio to 53.6% (37.7%).

Our associated company Nordic Option Oy is a venture capital fund investing primarily in growth-stage companies in Northern Finland. Our holding in Nordic Option is approximately 34%. Nordic Option Oy’s investments and loans totalled approximately EUR 17 million at the end of June 2023, with 14 target companies. Divestments of holdings have not taken place during the last two and a half financial years, and in Partnera’s profit outlook for 2023, Nordic Option has been taken into account as having a neutral impact on financial performance.

Dividend income from the Finda Oy holding during the review period was EUR 2.3 (1.0) million, representing a significant year-on-year increase. Over the past five financial years, dividend income to Partnera has totalled EUR 8 million. Partnera owns approximately 3.7% of Finda’s shares directly and approximately 1.8% indirectly through Telebusiness InWest Oy, totalling 5.5%. In Finda Group’s 2022 financial statements, the balance sheet total was EUR 1,087 million and equity was EUR 930 million.

The financial result of our associated company Telebusiness InWest Oy mainly consists of the dividend distributed by Finda Oy. Partnera received significantly more dividend income from Finda Oy than in the comparison period, which had a positive impact on the company’s financial result and thus also on the share of the profit of associated companies. Partnera owns approximately 36% of the shares of Telebusiness InWest Oy.

In June, we published a company release about our work to reorient our strategy and operations. The core idea is to clarify the Group’s mission and to assess both current and future holdings on this basis.

BUSINESS PERFORMANCE AND THE OPERATING ENVIRONMENT

Foamit Group

Foamit Group Oy is a Nordic glass recycling company and foam glass producer whose subsidiaries – Uusioaines Oy, Hasopor AB and Glasopor AS – together constitute one of Europe’s leading foam glass manufacturers. Foamit Group takes in and processes glass to be recycled and manufactures foam glass from the sidestreams of glass recycling. Foam glass is a 100% recycled lightening and insulating material. Partnera owns approximately 63% of Foamit Group, while Finnish Industry Investment Ltd owns approximately 32%.

In January–June 2023, Foamit Group’s net sales increased by 2.4% and amounted to EUR 21.3 (20.8) million. Net sales were boosted by increasing sales prices and volumes and the optimal product selection. In the Norwegian country company, sales developed positively, while in Sweden and Finland, net sales were impaired by the postponement of project starts. In Finland, the slowdown in building construction had a negative impact on the development of the company’s order book.

In the glass business, net sales from purified recycled glass increased by 3.1% year on year. Demand for circular economy products continues to grow in Europe and the Nordic countries. Foamit Group has responded to this by, among other things, increasing its production facilities’ capacity to produce high-quality products, thanks to which better-quality glass products can now be offered to an even wider customer base. The amount of recycled glass received decreased by 3.0% year on year, mainly due to a decrease in the amount of sidestreams from window factories. During the review period, Uusioaines Oy, part of Foamit Group, received 41,065 (42,330) tonnes of recycled glass. Uusioaines Oy received EcoVadis Silver Rating for its sustainability in spring 2023.

Foamit Group’s EBITDA amounted to EUR 3.9 (2.8) million in January–June 2023. The company’s profitability has improved both due to the decrease in energy costs and due to the efficiency measures implemented – and still continuing to be implemented – in the Norwegian and Swedish country companies. The measures focus on improving the profitability of sales, increasing production efficiency, saving energy and reducing fixed costs. In addition, profitability was influenced by the electricity subsidy granted to Foamit’s subsidiary Hasopor by the Swedish Parliament (Riksdag) in May, amounting to approximately EUR 0.9 million.

Foamit Group’s order book amounted to EUR 17.5 (17.1) million at the end of the review period. The major order received by Foamit in early 2022 to supply foam glass for a hospital construction project in Drammen, Norway, during 2022–2023, has now been fully delivered. The value of orders received in Sweden has decreased compared to last year, but on the other hand, the value of orders received in Finland has been increasing.

The synergy benefits of the acquisitions made by Foamit Group in recent years are starting to materialise. Operating in the Nordic countries, Foamit is well positioned to take advantage of the opportunities offered by the markets, thanks to increased resources. Efficiency improvements are expected to have a significant impact on enabling future growth, by concentrating and enhancing resource usage and Nordic-level delivery readiness, for example. Sharing best practices and expertise is expected to support sales, improve operational efficiency, and support the organisations of the country companies.

KPA Unicon

Earlier in the spring, Partnera announced that KPA Unicon and its owners estimated that corporate restructuring would make it possible to rearrange the debts and liabilities of KPA Unicon’s projects that had suffered from delivery difficulties and to assess different strategic options. On 13 March 2023, Due2Energy Oy’s, KPA Unicon Group Oy’s and KPA Unicon Oy’s Extraordinary General Meetings decided to apply for corporate restructuring proceedings and submitted the applications to the Oulu District Court. On 22 March 2023 and 6 April 2023, the District Court issued decisions on the start of the corporate restructuring proceedings.

On 16 May 2023, the restructuring administration of the companies took the position that there were grounds for the suspension of the proceedings as provided for in the Restructuring of Enterprises Act. The companies were insolvent and, according to the assessments made by the restructuring administration, it was likely that the insolvency could not be eliminated by means of a restructuring programme. Moreover, there was a pronounced risk that the conditions for the establishment or confirmation of the companies’ restructuring programmes would not be met.

On 12 May 2023, Due2Energy Oy submitted, by the restructuring administrator, to the insurer and the sellers the claim letters related to the acquisition in accordance with the purchase agreement and the warranty and indemnity insurance. With the claim letters, Due2Energy Oy secured the right to submit to the insurer and the sellers any subsequent claims in connection with the acquisition.

On 16 May 2023, the Boards of Directors of Due2Energy Oy, part of Partnera Group, and its subsidiaries KPA Unicon Group Oy and KPA Unicon Oy decided to file for bankruptcy at the Oulu District Court, which issued its decision on the bankruptcy of the companies on 25 May 2023. From now on, measures related to the companies, including the provision of information, are the responsibility of the bankruptcy administration.

The background factors for the bankruptcy included delivery difficulties in long-term international power plant project deliveries, which impaired the development of KPA Unicon’s business. Travel restrictions caused by the COVID-19 pandemic and rising costs hampered progress on projects. Partnera owned 70% of Due2Energy Oy, and Prounicon Service Oy owned 30%. KPA Unicon Group Oy and KPA Unicon Oy were wholly owned subsidiaries of Due2Energy Oy.

The total funds used by Partnera on KPA Unicon amounted to approximately EUR 25 million. The amount does not include any funds that may be paid to Partnera from the warranty and indemnity insurance, the sellers or the bankruptcy estate. Following KPA Unicon’s bankruptcy, Partnera’s balance sheet decreased significantly in the review period, showing a year-on-year decrease of EUR 83.3 million. Profit and balance sheet impacts increased Partnera’s equity ratio to 53.6% (37.7%).

Other strategic holdings

In addition to Foamit Group, Partnera’s strategic holdings include the associated company Nordic Option Oy, in which Partnera holds a stake of approximately 34% through Oulu ICT Sijoitus Oy. Nordic Option is a venture capital fund in the form of a limited liability company. Oulu ICT Sijoitus is a wholly-owned subsidiary of Partnera that engages in investment activities. In Partnera, Nordic Option’s financial result influences the share of the profit of associated companies.

Nordic Option contributes to building growth in small and medium-sized growth-stage companies primarily in Northern Finland by making capital investments in already established companies. Nordic Option Oy’s investments and loans totalled approximately EUR 17 million at the end of June 2023, with 14 target companies.

Other holdings

Partnera’s other holdings are Finda Oy and Telebusiness InWest Oy. Finda Oy is a Finnish investment group that engages in active portfolio investing, based on the principles of value investing. Finda Oy typically invests in listed companies. Partnera directly owns approximately 3.7% of Finda’s shares. In Finda Group’s 2022 financial statements, the balance sheet total was EUR 1,087 million and equity was EUR 930 million. During the review period, Partnera received EUR 2.3 million in dividends from Finda Oy. Over the past five financial years, dividend income to Partnera has totalled EUR 8 million.

Partnera owns approximately 36% of the shares of Telebusiness InWest Oy, which, in turn, owns approximately 5% of the shares of Finda. The financial result of Telebusiness InWest Oy mainly consists of the dividend distributed by Finda Oy. In Partnera, Telebusiness InWest Oy’s financial result influences the share of the profit of associated companies.

FINANCIAL PERFORMANCE

Impacts of KPA Unicon’s bankruptcy on the Group

During the review period, the income statement figures concerning KPA Unicon have been consolidated into the Group for the period 1 January–30 April 2023. As a result of KPA Unicon’s bankruptcy, the company’s significantly large balance sheet and accumulated losses are no longer consolidated into the Group figures.

Following KPA Unicon’s bankruptcy, Partnera has lost control over the subsidiaries, and these subsidiaries have disengaged from Partnera as of the bankruptcy date, 25 May 2023. Partnera considers that it has had control over the bankrupt subsidiaries until 30 April 2023.

Partnera recorded a positive impact on EBIT, EUR 5.6 million, from the loss of control due to the bankruptcy. The impact on EBIT mainly results from the fact that KPA Unicon’s loss-making net assets are no longer included in the Group. The impact on EBIT includes a EUR 4.3 million decrease in goodwill. In the key figures presented, the comparable operational EBIT has been adjusted for the write-down of goodwill. The bankruptcy is not expected to have negative impacts on financial performance. The write-down entries made do not include any funds that may be paid to Partnera from the warranty and indemnity insurance, the sellers or the bankruptcy estate.

Net sales

Partnera Group’s net sales in January–June 2023 totalled EUR 28.0 (39.2) million. Foamit Group accounted for EUR 21.3 (20.8) million of the consolidated net sales, while KPA Unicon accounted for EUR 6.7 (18.4) million.

| Net sales, EUR million | H1/20231) | H1/2022 | 2022 |

| Foamit Group | 21.3 | 20.8 | 45.7 |

| KPA Unicon | 6.7 | 18.4 | 39.7 |

| Total | 28.0 | 39.2 | 85.4 |

1) KPA Unicon’s figures are for the period 1 January–30 April 2023.

Profitability

The Group’s EBITDA in January–June 2023 amounted to EUR 5.9 (-3.3) million. The EBITDA includes a share of EUR 1.1 (0.6) million of the profit of associated companies. Foamit Group’s EBITDA was EUR 3.9 (2.8) million, and KPA Unicon’s EBITDA was EUR 6.0 (-5.9) million. The figures for the review period under lines “KPA Unicon” and “Group, other” include entries related to the bankruptcy of KPA Unicon.

| EBITDA, EUR million | H1/20231) | H1/2022 | 2022 |

| Foamit Group | 3.9 | 2.8 | 6.5 |

| KPA Unicon | 6.0 | -5.9 | -8.5 |

| Share of the profit of associated companies | 1.1 | 0.6 | 0.5 |

| Group, other | -5.1 | -0.8 | -1.5 |

| Total | 5.9 | -3.3 | -2.9 |

1) KPA Unicon’s figures are for the period 1 January–30 April 2023.

The Group’s EBIT in January–June 2023 amounted to EUR 2.8 (-7.4) million. Foamit Group’s EBIT was EUR 1.4 (0.2) million, and KPA Unicon’s was EUR 1.2 (-7.3) million. The figures for the review period under lines “KPA Unicon” and “Group, other” include entries related to the bankruptcy of KPA Unicon.

| EBIT, EUR million | H1/20231) | H1/2022 | 2022 |

| Foamit Group | 1.4 | 0.2 | 1.4 |

| KPA Unicon | 1.2 | -7.3 | -19.3 |

| Group, other | 0.2 | -0.3 | -1.0 |

| Total | 2.8 | -7.4 | -18.9 |

| Items affecting comparability2) | 4.3 | 0.0 | 8.0 |

| Operational EBIT, comparable | 7.1 | -7.4 | -10.9 |

1) KPA Unicon’s figures are for the period 1 January–30 April 2023.

2) Goodwill write-down for KPA Unicon.

The Group’s profit for January–June 2023 came to EUR -0.1 (-7.7) million. Foamit Group’s profit was EUR -1.8 (-1.5) million, and KPA Unicon’s was EUR -2.5 (-9.9) million. The profit includes EUR 2.3 (1.0) million in dividend income from minority interests, and imputed exchange rate effects recognised in financial income and expenses in the amount of EUR -1.8 (-1.5) million. The share of the profit of the associated companies Telebusiness InWest Oy and Nordic Option Oy was EUR 1.1 (0.6) million. The consolidated earnings per share amounted to EUR -0.00 (-0.21). The figures for the review period under lines “KPA Unicon” and “Group, other” include entries related to the bankruptcy of KPA Unicon.

| Profit, EUR million | H1/20231) | H1/2022 | 2022 |

| Foamit Group | -1.8 | -1.5 | -1.6 |

| KPA Unicon | -2.5 | -9.9 | -28.4 |

| Share of the profit of associated companies | 1.1 | 0.6 | 0.5 |

| Dividend income from minority interests | 2.3 | 1.0 | 1.0 |

| Group, other | 0.7 | 2.1 | 4.3 |

| Total | -0.1 | -7.7 | -24.1 |

1) KPA Unicon’s figures are for the period 1 January–30 April 2023.

Balance sheet, financing and investments

The consolidated balance sheet total amounted to EUR 86.8 (170.1) million at the end of the review period. The year-on-year decrease in the balance sheet total was due to the end of KPA Unicon’s consolidation into the Group accounting. The Group’s equity totalled EUR 45.0 (61.4) million, or EUR 1.24 (1.70) per share. The Group’s equity ratio was 53.6% (37.7%). In determining the Group’s equity per share, properties, subsidiaries and associated companies are measured at acquisition cost.

During the review period, the Group’s investments amounted to EUR 1.2 (1.5) million. Cash and cash equivalents totalled EUR 6.8 (8.8) million at the end of the review period. Net cash flow for the review period came to EUR -3.0 (-4.3) million.

The Group has a total of EUR 7.5 (9.9) million in liquid assets in the form of low-risk securities and other investment instruments, as well as cash and cash equivalents.

The Group’s return on equity was -0.7% (-23.2%) during the review period.

Financial covenants

Partnera’s financing arrangements include, for example, termination conditions related to financial performance indicators, namely the equity ratio, EBITDA, and the ratio between interest-bearing liabilities and EBITDA.

PERSONNEL

At the end of June 2023, the Group had 103 (325) employees, of whom 5 (4) worked for the parent company. The Group had 230 (308) employees on average during the period under review. The parent company’s average number of employees during the review period was 4 (4).

| Number of personnel at the end of the period | H1/20231) | H1/2022 | 2022 |

| Foamit Group | 98 | 97 | 97 |

| KPA Unicon | 224 | 198 | |

| Partnera | 5 | 4 | 4 |

| Group, total | 103 | 325 | 299 |

1) KPA Unicon’s figures are for the period 1 January–30 April 2023.

CHANGES IN THE MANAGEMENT

Partnera Corporation’s Board of Directors and CEO Jari Pirkola agreed that Pirkola would leave his position as Partnera Corporation’s CEO on 17 May 2023. Pirkola had been the company’s CEO since October 2017. Partnera Corporation’s Board of Directors has appointed Peter Vapaamies (M.Sc. Eng., MBA, CTP) as the Group’s Interim CEO as of 17 May 2023. After the review period, Peter Vapaamies was appointed as the Group’s CEO as of 24 August 2023.

ANNUAL GENERAL MEETING AND GOVERNANCE

Partnera Corporation’s Annual General Meeting was held on 20 April 2023 in Oulu, Finland.

The Annual General Meeting adopted the financial statements and discharged the members of the Board of Directors and the CEO from liability for the financial year 1 January 2022–31 December 2022.

In accordance with the proposal of the Board of Directors, the Annual General Meeting decided that no dividend be paid on the basis of the balance sheet adopted for the financial year 1 January–31 December 2022.

In accordance with the proposal of the Shareholders’ Nomination Committee, the Annual General Meeting confirmed the number of members of the Board of Directors as five (5). Mirja Illikainen, Marko Järvinen, Sami Mäentausta and Erja Sankari were re-elected as members of the Board of Directors. Jari Pirinen was elected to the Board of Directors as a new member. Jari Pirinen was elected as the Chair of the Board of Directors, with Sami Mäentausta as the Deputy Chair.

The Annual General Meeting confirmed the annual and meeting fees of the members of the Board of Directors in accordance with the proposal of the Nomination Committee. The members and the Deputy Chair of the Board of Directors are paid an annual fee of EUR 10,000 each and the Chair of the Board of Directors is paid an annual fee of EUR 18,000. In addition to the annual fees, the members and the Deputy Chair of the Board of Directors are paid a meeting fee of EUR 400 per Board meeting, the Chair of the Board of Directors EUR 800 per Board meeting, the chairpersons of the committees EUR 800 per committee meeting, and the members of the committees EUR 400 per committee meeting. The travel expenses of the members of the Board of Directors and its committees are compensated in accordance with the company’s travel policy.

The audit firm Ernst & Young was re-elected as the company’s auditor, with authorised public accountant Jari Karppinen continuing as the responsible auditor. It was decided that the auditor’s fees will be paid in accordance with their reasonable invoice approved by the company.

THE BOARD OF DIRECTORS’ CURRENT AUTHORISATIONS

The Annual General Meeting of 20 April 2023 authorised Partnera Corporation’s Board of Directors to decide on issuing at most a total of 7,480,000 shares or issuing special rights entitling to shares, in accordance with Chapter 10, Section 1 of the Limited Liability Companies Act, in one or more instalments while the authorisation remains in effect. The Board of Directors can decide to either issue new shares or shares held by the company. The proposed maximum amount of the authorization corresponds to approximately 20% of the company’s total shares.

The authorization can be used to develop the company’s capital structure, expand its ownership, fund or implement acquisitions or other arrangements, implement a share-based remuneration scheme, or for other purposes decided upon by the Board of Directors.

The authorisation includes the Board of Directors’ right to decide on all conditions of share issuance and provision of special rights in accordance with Chapter 10, Section 1 of the Limited Liability Companies Act, including recipients of shares or special rights entitling to shares, and the consideration to be paid. The authorisation thereby also includes the right to issue shares or special rights in deviation from the pre-emptive subscription right of shareholders, according to the prerequisites stipulated by the law.

The authorisation is valid until the next Annual General Meeting, but no later than 30 June 2024, and it replaces the corresponding authorisation granted to the Board of Directors by the Annual General Meeting of 21 April 2022.

SHARES AND SHAREHOLDERS

Partnera Corporation’s share capital and the number of shares remained unchanged during the review period. Partnera Corporation’s share capital on 30 June 2023 amounted to EUR 6,413,182.05, and the number of shares was 37,401,966. The company has one series of shares and all shares confer one vote and equal rights to dividends. At the end of the review period, the parent company held a total of 1,240,772 treasury shares.

On 30 June 2023, Partnera Corporation had a total of 25,616 (26,258) shareholders. The 10 largest registered shareholders collectively held 65.84% (65.7%) of the company’s shares.

| Shareholder | Number of shares | Shares, % |

| City of Oulu | 17,634,491 | 47.15 |

| Arvo Invest Nordic Oy | 3,810,652 | 10.19 |

| Partnera Corporation | 1,240,772 | 3.32 |

| Pakarinen Janne Heikki Petteri | 472.036 | 1.26 |

| Japak Oy | 377.062 | 1.01 |

| Oulun Kulta Oy | 267,000 | 0.71 |

| Mininvest Oy | 232.571 | 0.62 |

| Pohjanmaan Arvo Sijoitusosuuskunta | 212,500 | 0.57 |

| Haloan Oy | 200.299 | 0.54 |

| Osuuskauppa Arina | 177,850 | 0.48 |

| 10 largest shareholders, total | 24,625,233 | 65.84 |

| Others | 12,776,733 | 34.16 |

| Total | 37,401,966 | 100.00 |

TRADING IN THE COMPANY’S SHARES

During the period 1 January–30 June 2023, a total of 656,387 Partnera shares, or 1.8% of the total number of shares, were traded on Nasdaq First North Growth Market Finland. The total value of the trading was EUR 0.5 million.

On the final trading day of the review period, the closing price was EUR 0.70 per share. The share price low during the financial year was EUR 0.65, the high was EUR 0.90, and the average share price was EUR 0.76 per share. At the end of the review period, Partnera’s market capitalisation was EUR 26.2 million. At the end of 2022, the market capitalisation was EUR 28.1 million.

SHARE-BASED INCENTIVE SCHEMES

In March 2022, Partnera Corporation’s Board of Directors decided on the new earnings period for the long-term incentive scheme for the Group’s key personnel. The purpose of the scheme is to bring together the objectives of the company’s owners and the scheme’s participants in order to increase the value of the company in the long term, as well as commit key personnel to the company and offer them a competitive remuneration system based on earning and accumulating the company’s shares.

The scheme has three earnings periods, the calendar years 2021–2023, 2022–2024, and 2023–2025. The Board of Directors will decide the scheme’s earnings criteria and the aims set for each criterion at the start of each earnings period.

The remuneration will be paid partly in the company’s shares and partly in cash in 2024, 2025, and 2026. The cash portion is intended to cover the taxes and other levies incurred by the participant due to the remuneration. As a rule, remuneration will not be paid if the participant’s employment or service with the company ends before the payment of the remuneration.

The remuneration from the scheme’s second earnings period will be based on the total shareholder return (TSR) of Partnera Corporation’s shares during the period 2022–2024.

The remuneration to be paid based on the earnings period of 2022–2024, with the number of participants at the start of the period, corresponds to, at most, the value of 74,968 of Partnera Corporation’s shares, including the portion to be paid as cash. The target group of the scheme is the persons belonging to the company’s management during the earnings period of 2022–2024.

The Board of Directors decides on the offering of shares in relation to the scheme within the bounds of the authorizations granted in the Annual General Meeting. The Board of Directors can also decide on paying remuneration as cash.

RISK MANAGEMENT AND THE MOST SIGNIFICANT NEAR-TERM RISKS

Partnera’s risk management is aimed at the comprehensive and proactive management of risks in accordance with the company’s risk management policy. Partnera aims to detect and identify factors that could have a negative impact on the achievement of the company’s targets in the long or short term, and to undertake the necessary measures to manage such factors. In risk management, an important role is played by risk management at the group company level, the central aspects of which are organized by the Group’s subsidiaries and associated companies. Partnera promotes the risk management of the group companies by engaging in active ownership steering and by participating in the work of the group companies’ boards of directors.

Through its operations, Partnera is exposed to general market risks, as well as risks related to the group companies’ business operations, financial risks, and risks related to the execution of the Group’s growth strategy.

Market risks

Increasing uncertainty in the international economy and international politics may have an impact on the demand for, and costs of, the products and services of Partnera and its subsidiary Foamit Group. Such factors may lead to the postponement or complete cancellation of investments. Rising costs and material availability issues have an impact on the competitiveness and profitability of the Group’s subsidiary.

The customers of Partnera’s subsidiary Foamit Group include public sector entities and organisations that are funded by public expenditure. Consequently, the subsidiary is exposed to cyclical fluctuations in public investment. Foamit Group’s customer base also includes customers that engage in the construction business, which means that Foamit Group is exposed to cyclical fluctuations in construction.

Business risks

Through its operations, Partnera is exposed to the business risks of its subsidiary Foamit Group, which are influenced by the increasing uncertainty in the economy and international politics. The group companies’ business risks are related to areas such as contracts, cost assessment, schedules, quality, performance, subcontractors and material management. These risks may lead to higher costs, payment delays and an increased risk of credit losses.

Partnera and its subsidiary Foamit Group are exposed to legal, economic, political and regulatory risks related to the countries in which the companies’ customers or partners are located. Such risks may lead to delays in deliveries, orders being lower than projected, exchange rate losses, changes in the customers’ ability to pay and payment behaviour, higher costs, and legal proceedings and related expenses.

The operational activities of Partnera and its subsidiary Foamit Group, and the development of their business areas, may involve structural changes in the business environment. If such changes materialise, they may trigger the realisation of the aforementioned risks. Examples of such changes and events include technological development, digitalisation, sustainability risks and risks related to cyber security. If such risks materialise, they may lead to products and services failing to meet the customers’ expectations, disruptions in services and processes, financial losses due to criminal actions, and/or reputational damage. In addition, changes in the regulatory environment may have a significant impact on business operations.

Partnera’s subsidiary has significant customer projects, and if those projects were to continue in a manner that deviates from expectations, it could lead to significant deviations with regard to the future outlook. The typical risks associated with the project business include a dependence on actual order and delivery volumes, timing-related risks, and potential delays in projects. These factors may be reflected in weaker profitability or fluctuations in cash flow.

Expanding Partnera through new acquisitions is an important component of the execution of the Group’s strategy. Acquisitions involve risks, and these risks are managed by carrying out acquisitions in accordance with a five-stage process defined by the company, using external experts.

The impacts of the war in Ukraine

The war in Ukraine has had an impact on the business operations of Partnera and its subsidiary Foamit Group by increasing market uncertainty and price fluctuations in materials and energy. Partnera or its subsidiaries do not have operations or sales in the Russian, Belarusian or Ukrainian markets.

Financial risks

In its business operations, Partnera is exposed to interest rate and exchange rate risk, credit loss risk, liquidity risk and price risk, as well as investment and financial market risks in connection with the investment of liquid assets, for example. Changes in the investment and financial markets have an impact on the value of Partnera’s parent company’s liquid assets. In accordance with the Group’s strategy, its liquid assets have been invested in low-risk financial instruments.

Partnera finances its business activities through revenue from operational business activities and by additional financing obtained on market terms. The company has loans and credit limit agreements that include normal terms and conditions concerning the equity ratio and EBITDA as well as the disposal and collateralisation of assets. Violations of the terms of financing and failure to fulfil other obligations under financing agreements could significantly increase the costs of financing and even jeopardise the continued financing of Partnera or its subsidiary. In addition, rising inflation may lead to higher interest rates, which increase financing costs and reduce the profitability of Partnera and its subsidiary.

The realisation of business risks or the weaker-than-expected development of business could weaken the availability and terms of financing and lead to a need for additional financing and additional working capital.

EVENTS AFTER THE REVIEW PERIOD

Peter Vapaamies was appointed as the Group’s CEO as of 24 August 2023.

Oulu, 24 August 2023

Partnera Corporation

Board of Directors

More information

Peter Vapaamies, CEO, Partnera Corporation

telephone: +358 40 777 9269

e-mail: peter.vapaamies@partnera.fi

Certified advisor, EY Advisory Oy

telephone: +358 207 280 190

e-mail: ollipekka.kotkajuuri@fi.ey.com

Distribution

Nasdaq Helsinki

Key media

Company website

Partnera in brief

Partnera is an international business group that promotes sustainable development with its operations through the companies it owns. Partnera Corporation’s shares are listed on Nasdaq First North Growth Market Finland.

TABLES

Accounting policies

The figures for January–June 2023 and 2022 are unaudited and prepared in accordance with the Finnish Accounting Standards (FAS). The figures for January–December 2022 are audited. The figures in the tables are rounded and presented in thousands of euros. KPA Unicon is consolidated into the Group for the period 1 January 2023–30 April 2023, after which it is no longer consolidated into the Group accounting.